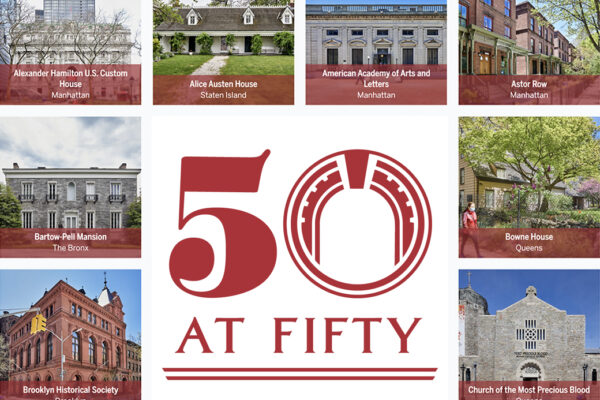

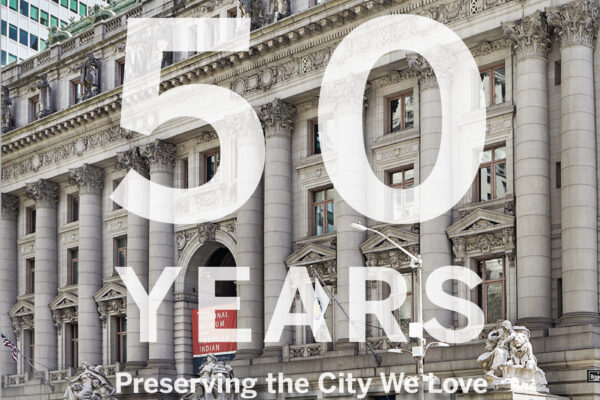

New Yorkers are fortunate to be surrounded by diverse examples of architecture dating from the 18th to the 20th century. Owners of these historic buildings need access to objective, technical expertise to be able to care for them. Nationally recognized for its expertise, the Conservancy’s Preservation Services program provides exactly that to owners of historic residential, religious, public, and commercial buildings.

A lovely new book about restoring city homes features practical advice and suggestions from the Conservancy’s former Technical Director, Alex Herrera. “Restoring A House In The City: A Guide To Renovating Town Houses, Brownstones and Row Houses With Great Style” by Ingrid Abramovitch is published by Artisan.

Through the Preservation Hotline, the Conservancy fields questions about building repair, project management, and contractor referrals. For issues that cannot be resolved over the phone, the staff makes site visits and meets with owners, architects, and contractors. We can also provide, on a fee basis, historical research reports on a property, National Register nominations, maintenance plans, and feasibility studies.

Conservancy staff also serve as project advisors, offering assistance with requests for proposals, budgets, grant applications, nominations for listing in the National Register of Historic Places, and local and state design review approvals.